2021 electric car tax credit california

The number of taxpayers claiming the tax credits. GET FEDERAL TAX CREDITS AND STATE INCENTIVES FOR YOUR JEEP 4xe VEHICLE.

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

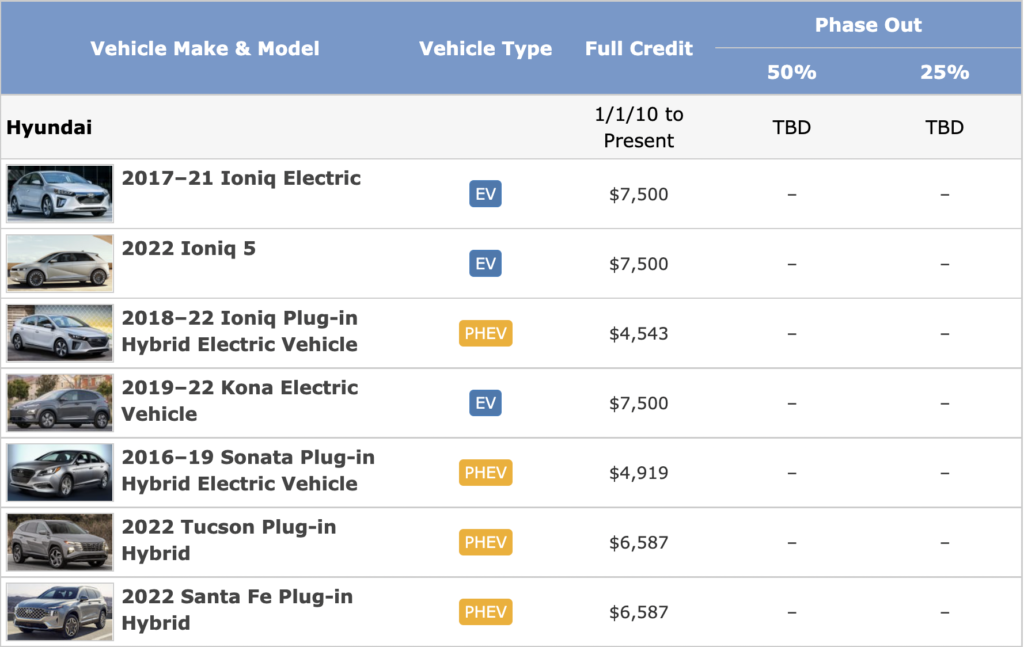

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks.

. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles. 4500 for fuel cell electric vehicles FCEVs 2000 for battery electric vehicles 1000 for plug-in hybrid electric vehicles.

The federal government provides a substantial tax credit for new battery electric and plug-in hybrid electric vehicles ranging from 2500 - 7500 depending on the capacity of the electric. A good rule of thumb for people thinking of purchasing an EV. The credit amount will vary based on the capacity of the.

We have some great news. Local and Utility Incentives. The electric vehicle tax credit or the EV credit is a nonrefundable tax credit the IRS offers taxpayers who purchase qualifying plug-in electric or clean vehicles.

Discover electric vehicle tax credits in California and buy a new Toyota PHEV at our Victorville Toyota dealer. That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre-owned clean vehicles that are two or more years old cost. For vehicles acquired after 12312009.

And April 7 2021. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Find current credits and repealed credits with carryover or recapture provision.

If you purchase or lease a Jeep Plug-in Hybrid Electric Vehicle PHEV you. The credit begins to phase out for a manufacturer when that manufacturer sells. Electric Vehicles Solar and Energy Storage.

This requirement went into effect on August 17 2022. Tax credits allowed by this act meet the goals purposes and objectives of these credits are as follows. The ZIP codes in which electric.

Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and. SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40. Learn more about EV tax rebates in CA.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Commercial Solar Electric System.

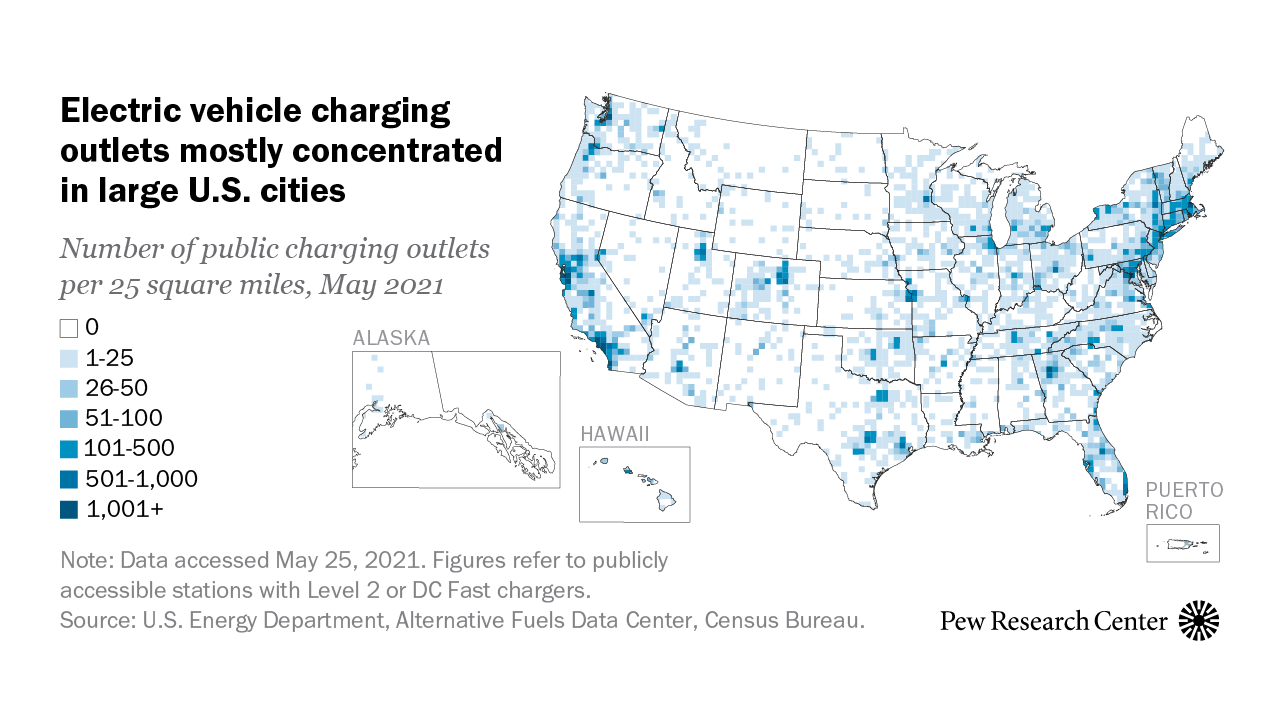

Electric Vehicle Market Growing More Slowly In U S Than China Europe Pew Research Center

Evs Offer The Biggest Discounts Despite Chip Shortage Carsdirect

How To Get A Tesla Model 3 For 25 000 In California Cleantechnica

Electric Vehicle Tax Credit How It Works What Qualifies Nerdwallet

Climate Bill Would Create Roadblock For Full Ev Tax Credit E E News

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

What To Know About The Complicated Tax Credit For Electric Cars Npr

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Electric Vehicles San Jose Clean Energy

Electric Car Use By Country Wikipedia

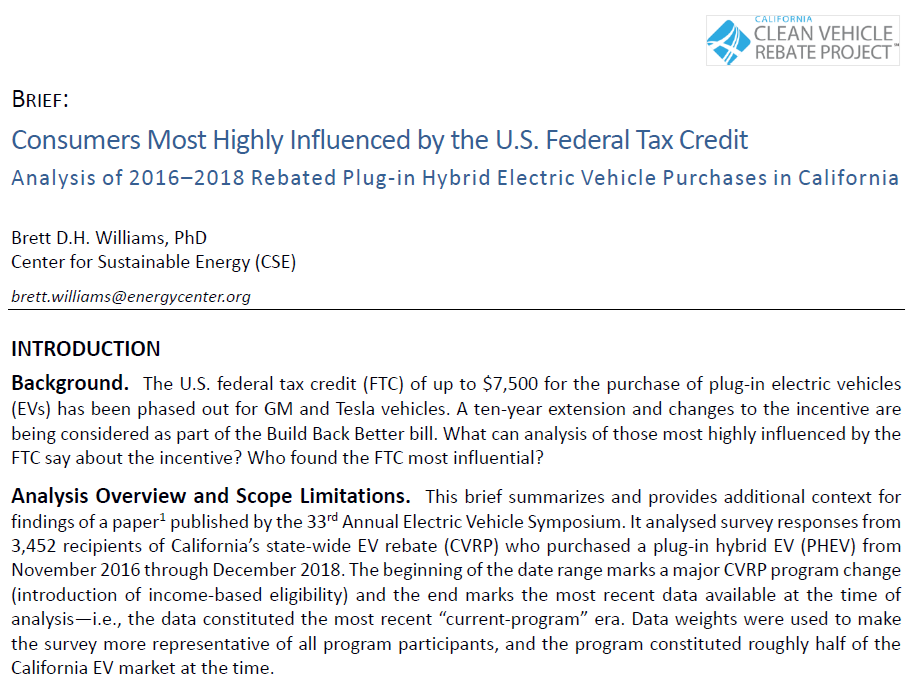

Presentation California Plug In Hybrid Electric Vehicle Consumers Who Found The U S Federal Tax Credit Extremely Important In Enabling Their Purchase Center For Sustainable Energy

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Southern California Edison Incentives

Biden Proposal For Electric Vehicle Tax Credits Irks Canada And Mexico The San Diego Union Tribune

Us Plug In Cars Sales Approached 5 Market Share Q4 2021

Program Reports Clean Vehicle Rebate Project

Solar Powered Ev Car Charging Manufacturer Receives 2 5 Million In Tax Credits Pv Magazine Usa